Brivo Data Intelligence

Building Occupancy Levels

Across America

Brivo Data Intelligence

Building Occupancy Levels

Across America

Trends in the Workplace

We wanted to take a look at the overall workplace trends. What happened,and where are we likely headed? As it stands, we’re still well under the pre-pandemic occupancy levels, but those lower levels have established a bit of normalcy, especially when you look at common holidays.

Interestingly last year saw the workplace levels flatten, but the expectation is that the increased pressure to return to the office from management across a variety of industries. That should start to appear in the data over the next two quarters.

Occupancy by Day of the Week

Tuesday and Wednesday have near parity across the board as the two most in-office days, usually followed by Thursday, and then Monday.

OCCUPANCY BY DAY

OF THE WEEK

OCCUPANCY BY

INDUSTRY AND CITY

Occupancy by Industry and City

On the city side, this captures the movement of people between cities, due to remote work availability, level of restrictions, and local economic performance.

From an industry view, you can pinpoint when spaces like sports facilities were converted for other uses, when schools closed, and of course the inverse, as the nation reopened, you can see when sectors like hospitality picked up as well.

Looking Locally

We’ve identified eight cities worth breaking out based how they befored before, during, and after the pandemic, and then created a nationwide average.

We see a similarity in most markets across their starting opening rates, but some cities saw heavier hits at the start of the pandemic, such as NYC and San Francisco, as people moved, where as cities in Texas didn’t see much difference.

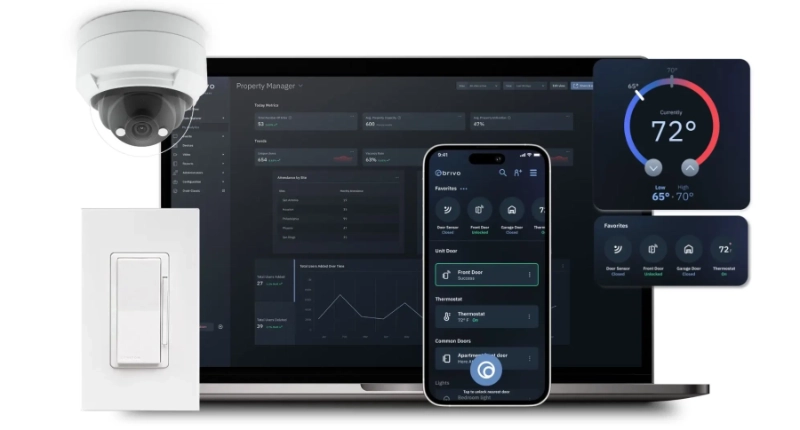

About Brivo

Brivo data tells a similar story when we look at eleven metropolitan areas across the country. We see that the country has returned to work above the pandemic levels, but we are still below the pre-pandemic levels. The most interesting descriptors are, of course, city and industry.

When we look specifically at the top ten sectors on the Brivo index, all ten have seen workers return Post-Pandemic, up on average 35% from Mid-Pandemic, with Retail, Mining, and Finance/Insurance/Real Estate rounding out the top three. However, when we look at Pre-Pandemic to Post-Pandemic, only three industries have increased: Agriculture/Forestry/Fishing, Construction, and Retail.

Featured In

How to Buy

How To Buy