AMSTERDAM and ROTTERDAM, February 28, 2022

Brivo — the global leader in cloud-based access control and smart building technologies that has entered into a definitive merger agreement with Crown PropTech Acquisitions (NYSE: CPTK) — today announced that the company has joined Bisner Workplace, a user-friendly smart workplace app to make offices more productive and efficient for employees and tenants.

The integration between Bisner and Brivo will enable tenants to handle all building requests such as room booking, parking with license plate recognition, access control to the building, and contract management from one app.

“With Brivo, we have found a partner with innovative cloud technology that is a valuable extended service for our tenants,” said Bisner founder Stefan van der Werf. “Access control is a vital addition to building technology to improve tenant services, and integrating this technology into our all-in-one solution helps offices stay organised and become more flexible.”

“We believe that the workplace of the future will be powered by technology more than ever, and that the combined power of Brivo and Bisner will simplify the management of hybrid workplaces and smart spaces,” said Steve Van Till, founder and CEO of Brivo. “Brivo is committed to expanding its partner ecosystem in Europe so property portfolio managers can save time and get more done with Brivo’s cloud-based tools.”

With this integration, flexible workspace managers can work in one system and do not have to bounce between multiple applications to manage access permissions to desks, rooms or spaces. Access assignments in the Bisner platform are automatically reflected in the Brivo platform. Employees are then able to access the appropriate spaces for which they are granted access through their mobile devices.

About Brivo

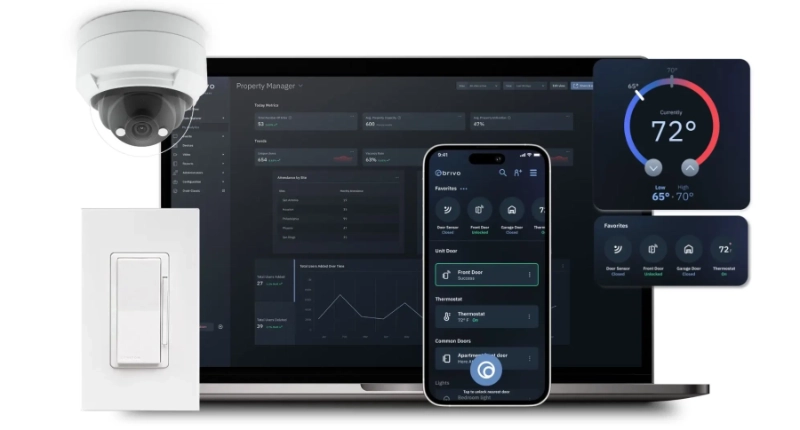

Brivo, Inc. created the cloud-based access control and smart spaces technology category over 20 years ago and remains the global leader serving commercial real estate, multifamily residential and large distributed enterprises. The company’s comprehensive product ecosystem and open API provide businesses with powerful digital tools to increase security automation, elevate employee and tenant experience and improve the safety of all people and assets in the built environment. Brivo’s building access platform is now the digital foundation for the largest collection of customer facilities in the world, occupying over 300 million square feet across 42 countries. On November 10, 2021, Brivo entered into a definitive merger agreement with Crown PropTech Acquisitions (NYSE: CPTK), which is anticipated to close in Q2 2022, subject to shareholder approvals and other closing conditions. The merger will result in Brivo becoming a publicly listed company on the New York Stock Exchange under the new ticker symbol “BRVS.” Additional information about the transaction can be viewed here: www.brivo.com/about/investor-relations. Legal Disclaimer: https://www.brivo.com/about/investor-relations/legal-disclaimer/.

This communication is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination (the “proposed business combination”) between Brivo, Inc. (“Brivo”) and Crown PropTech Acquisition Corp. (“Crown”) and related transactions and for no other purpose.

About Bisner

Bisner is the fastest growing cloud-based solution designed to simplify and improve work life, preparing real estate for the future-proof workplace. Providing any workplace worldwide with the most flexible, customisable and scalable solution. Their software is fully integrated and at the core of every successful multi-tenant / office ecosystem. With the Bisner Smart Workplace app, tenants and employees have all the necessary functionalities in one app for productive and efficient workdays, resulting in a powerful workplace experience.

BRIVO CONTACT:

Media Inquiries

Press@brivo.com

Investor Inquiries

Investors@brivo.com

BISNER CONTACT:

Stefan van der Werf

stefan@bisner.com

Forward Looking Statements

These communications include “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity and market share, expectations and timing related to commercial product launches, potential benefits of the proposed business combination and the potential success of Brivo’s go-to-market strategy, and expectations related to the terms and timing of the proposed business combination. These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations of Brivo’s and Crown’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Brivo and Crown. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination or that the approval of the shareholders of Crown or Brivo is not obtained; the lack of third party valuation in determining whether or not to pursue the proposed business combination; failure to realize the anticipated benefits of the proposed business combination; risks relating to the uncertainty of the projected financial information with respect to Brivo; the risk that the conditions to the financing for the proposed business combination may not be satisfied or waived; the effect of the announcement or pendency of the proposed business combination on Brivo’s business relationships, performance and business generally; risks that the proposed business combination disrupts current plans of Brivo and potential difficulties in Brivo employee retention as a result of the proposed business combination; the ability to implement business plans, forecasts and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities; Brivo’s ability to attract and retain customers; the combined company’s ability to up-sell and cross-sell to customers, including the success of Brivo’s customers’ development programs, which will drive future revenues; the ability of the combined company to compete effectively and its ability to manage growth; the amount of redemption requests made by Crown’s public shareholders; the ability of Crown or the combined company to issue equity or equity-linked securities in connection with the proposed business combination or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; the risk that the combined company’s securities will not be approved for listed on the New York Stock Exchange or if approved, that such listing will be maintained; and those factors discussed in Crown’s final prospectus dated February 8, 2021, Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, dated August 16, 2021 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, dated October 12, 2021, and the preliminary proxy statement/prospectus of Crown related to the proposed business combination dated December 22, 2021, in each case, under the heading “Risk Factors,” and other documents of Crown filed, or to be filed, with the Securities and Exchange Commission (“SEC”). If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Crown nor Brivo presently know or that Crown and Brivo currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Crown’s and Brivo’s expectations, plans or forecasts of future events and views as of the date of this communication. Crown and Brivo anticipate that subsequent events and developments will cause Crown’s and Brivo’s assessments to change. However, while Crown and Brivo may elect to update these forward-looking statements at some point in the future, Crown and Brivo specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Crown’s and Brivo’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information About the Proposed Business Combination and Where To Find It

The proposed business combination will be submitted to shareholders of Crown for their consideration. Crown filed a registration statement on Form S-4 (the “Registration Statement”) with the SEC which includes a preliminary proxy statement and will include, when available, a definitive proxy statement to be distributed to Crown’s shareholders in connection with Crown’s solicitation for proxies for the vote by Crown’s shareholders in connection with the proposed business combination and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Brivo’s shareholders in connection with the completion of the proposed business combination. After the Registration Statement has been declared effective, Crown will mail a definitive proxy statement and other relevant documents to its shareholders as of the record date established for voting on the proposed business combination. Crown’s shareholders and other interested persons are advised to read the preliminary proxy statement / prospectus and any amendments thereto and, once available, the definitive proxy statement / prospectus, in connection with Crown’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the proposed business combination, because these documents will contain important information about Crown, Brivo and the proposed business combination. Shareholders may also obtain a copy of the preliminary proxy statement or, once available, the definitive proxy statement as well as other documents filed with the SEC regarding the proposed business combination and other documents filed with the SEC by Crown, without charge, at the SEC’s website located at www.sec.gov or by directing a request to 667 Madison Avenue, 12th Floor, New York, NY 10065, attention: Nikki Sacks.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

Crown, Brivo and certain of their respective directors, executive officers and other members of management, employees and consultants may, under SEC rules, be deemed to be participants in the solicitations of proxies from Crown’s shareholders in connection with the proposed business combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Crown’s shareholders in connection with the proposed business combination is set forth in the Registration Statement. You can find more information about Crown’s directors and executive officers in Crown’s final prospectus dated February 8, 2021 and filed with the SEC on February 10, 2021. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the proxy statement / prospectus when it becomes available. Shareholders, potential investors and other interested persons should read the proxy statement / prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.