With great power comes great responsibility. In the information age, we understand that true power comes from knowledge. In the past, powerful knowledge came from new, paradigm shifting discoveries in science, technology, and medicine. Now this power also comes from data that is thoroughly gathered, organized and analyzed.

What can we do with data and how does it affect our lives? For one, data serves to aid in decision making that is critical to the quality of life for all those affected. In our current pandemic era, these decisions are crucial and must be made critically on fact-based assessment. The onus is on local and federal governing bodies, professional health organizations, businesses, and community leaders to ensure proper measures and guidelines are put into place in order to protect people and communities. The better they are informed, the more effective their decisions will be.

Where We’ve Been

At the start of 2020, decision makers faced their greatest challenge in the wake of COVID-19 and still continue to meet this challenge even as the year comes to an end. Fortunately, they aren’t alone and several organizations with access to large amounts of relevant data have made critical information and data points accessible to the public to help strengthen decision making. A few noteworthy contributors to data and analysis are The New York Times, CDC, World Health Organization and Brivo.

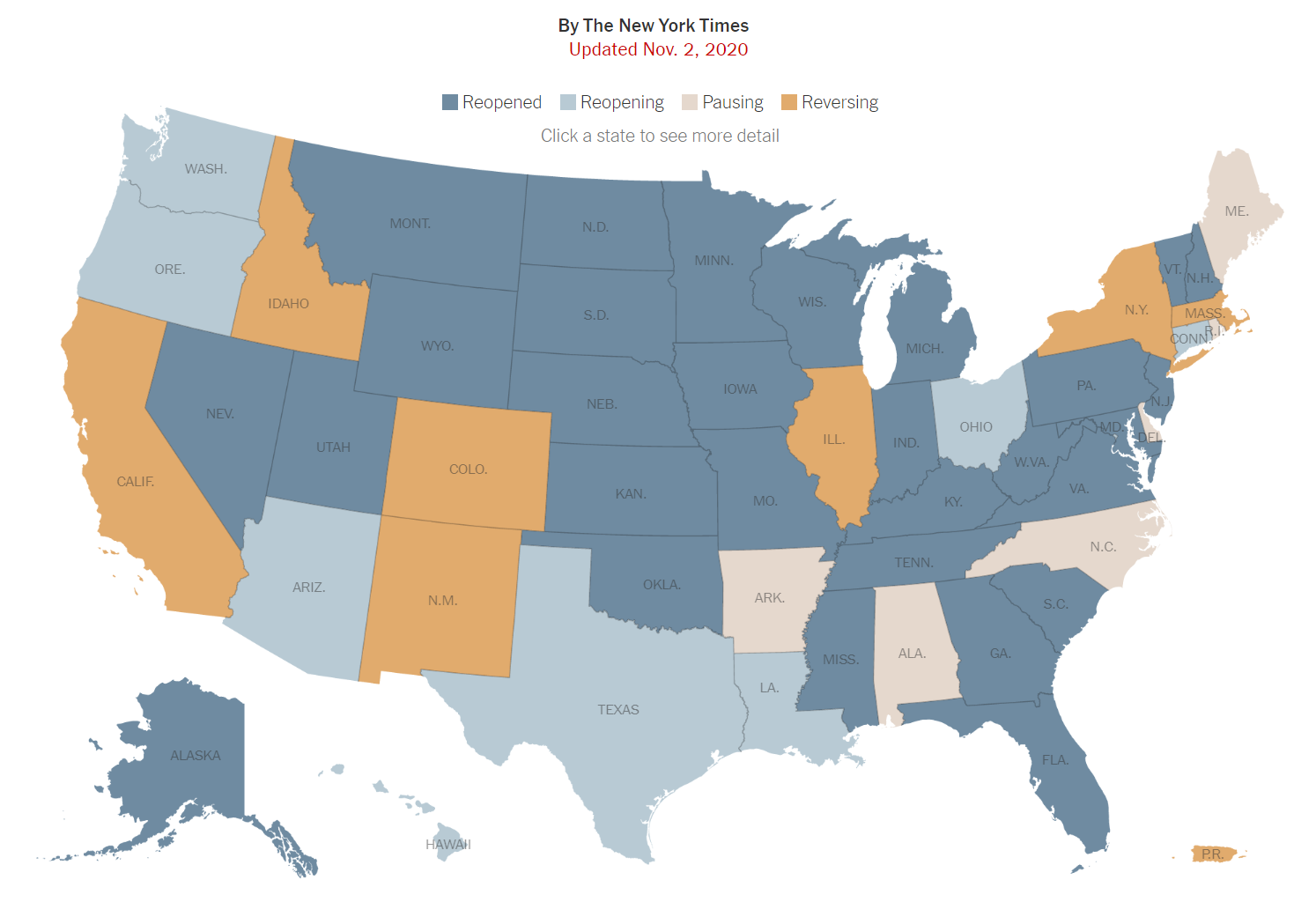

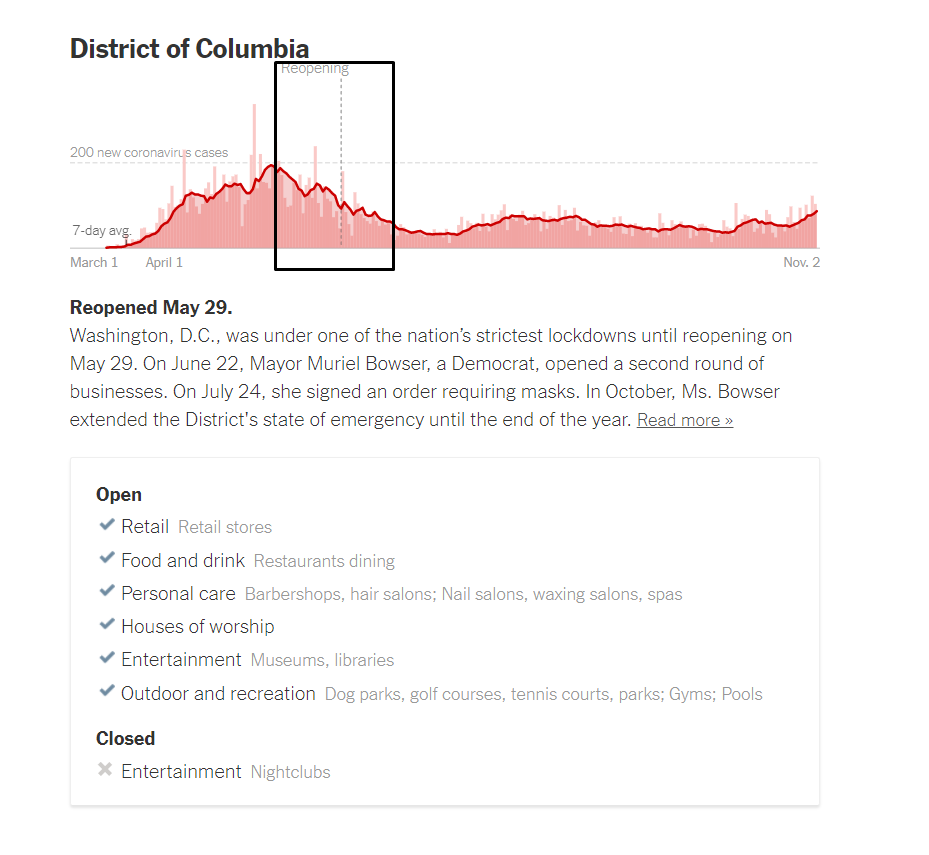

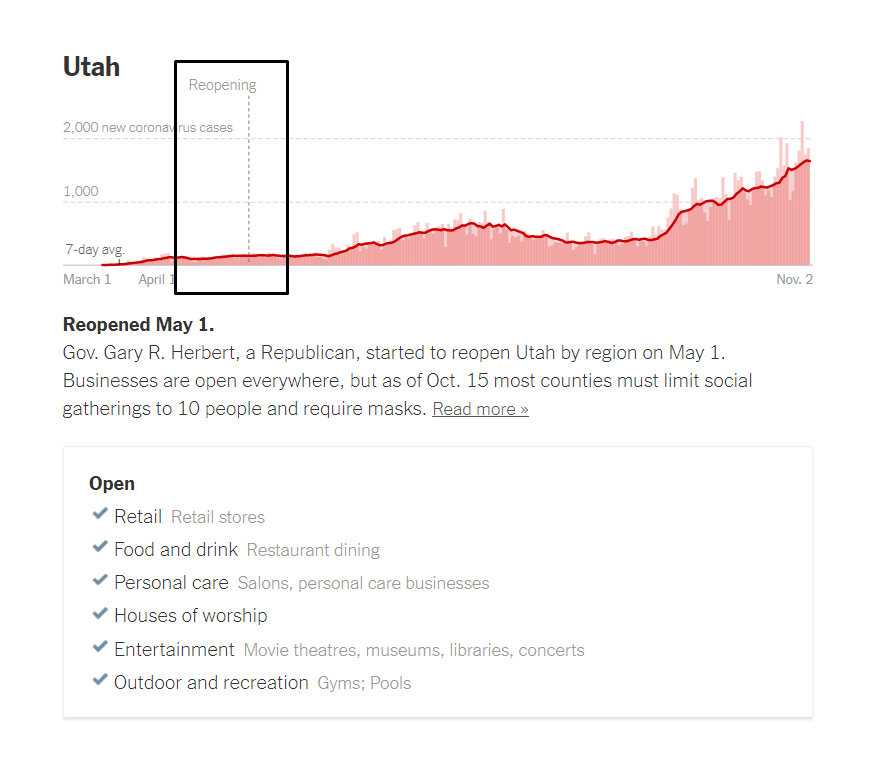

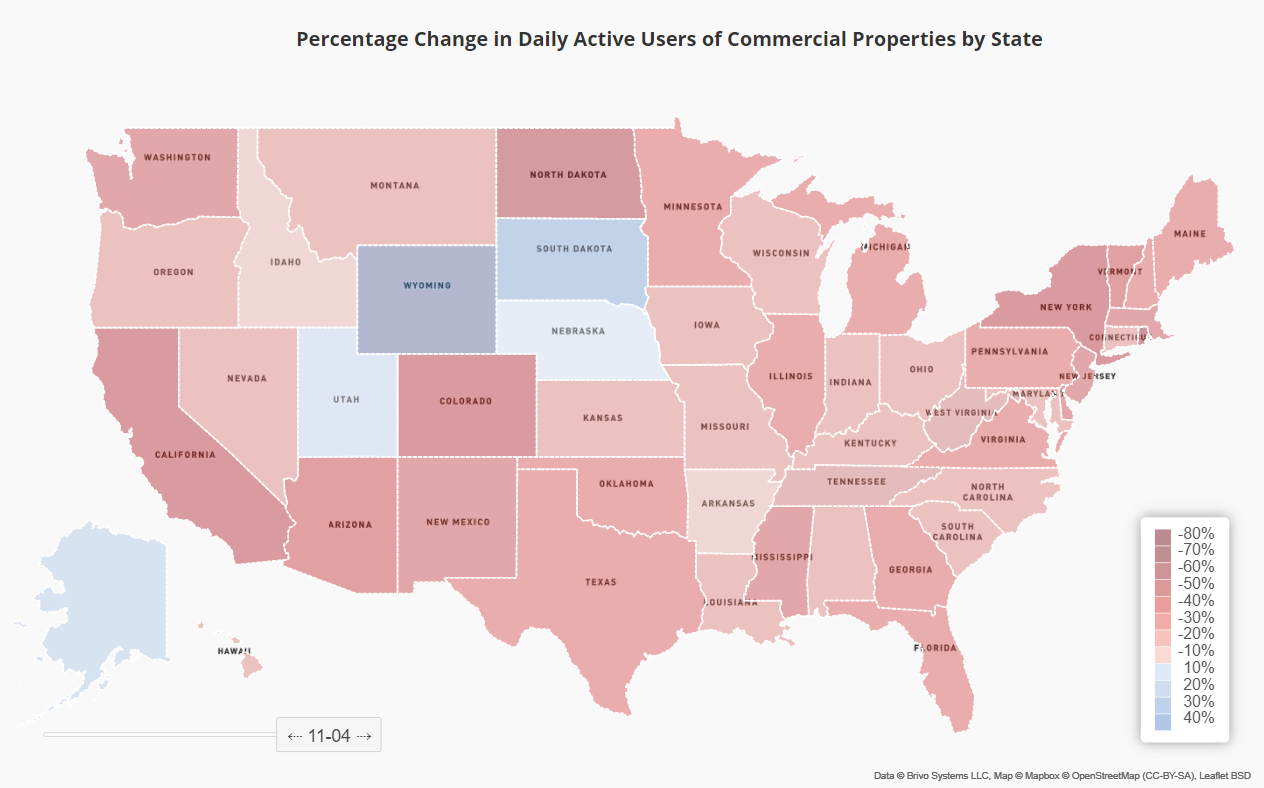

Brivo data, gathered from +20 million people across more than 50,000 locations, tracks access to offices, schools, multifamily dwellings, retail establishments, warehouses, government offices, houses of worship, and many more commercial properties. Brivo is tracking daily active users of commercial buildings over time, by state and even by industry. The New York Times is tracking restrictions on businesses and the reopening plans of each state. They are also tracking new coronavirus cases over time on a state by state level. When analyzing the sets of data from Brivo and The New York Times together there are substantial and significant insights to glean.

The New York Times is tracking coronavirus cases alongside the restrictions on businesses and reopening plans of all 50 states.

Source: https://www.nytimes.com/interactive/2020/us/states-reopen-map-coronavirus.html

As a comparison, the data provided by both organizations synergize a greater analysis. Each state’s reopening and quarantine plans are implemented through phases planned in advance. Due to the trajectory and fluctuation in the daily coronavirus case numbers of each state, reopening plans are bound to change. The goal for governors is to plan for a successful return to work and effectively slow the spread of the virus – all while constantly monitoring and being agile. To monitor the effectiveness of a phased plan, governors should analyze access control data for all industries. If mandated shutdown restrictions are met with a significant decrease in daily access activity followed by a decrease in daily coronavirus cases – then states can adjust plans and reconsider reopening dates accordingly.

Where We Are

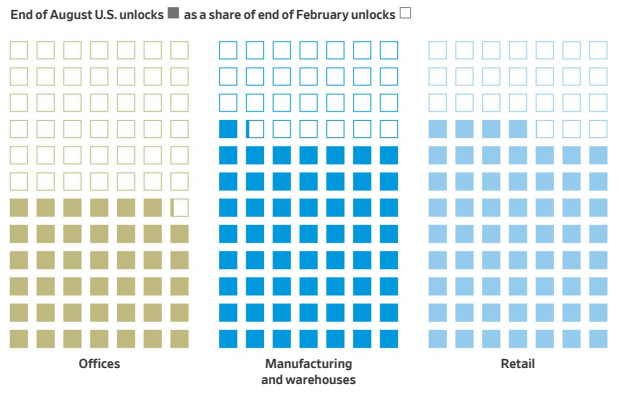

The Wall Street Journal took data collected and provided by Brivo and reimagined its visualization to cross examine and find patterns that can help better understand the state of the pandemic and where we go from here. They created graphs and tables to represent the number of times employees of commercial, retail, or industrial workplaces opened or unlocked secured doors – which are termed “unlocks.” This is in comparison to a baseline derived from the average level of “unlocks” since January and February which was right before the pandemic took hold in the US, forcing businesses to shut down and people to socially distance. They also stratified the data to show the share of unlocks against the baseline in different ways such as, on a state by state level, by industry type and even the combination of both.

“Commercial real estate here is a big question mark and something that a lot of investors are watching when we think about one year, two years down the road.” – Zack Guzman, Yahoo Finance

Business leaders are trying to understand what the impact of COVID-19 will be on their industries and customers and how long it may take to recover. When asked about the return to work, Jeff Nielsen had this to say,

“I think there was this initial optimism back in April, May, you know, this is going to be a short-term thing – [with many thinking] we’ll be back to normal by end of the summer, maybe the end of the year. And what we see in this data certainly is that, no one is rushing to go back to the normal pattern of office usage, certainly in traditional offices like the one I work in.”

This notion seems to apply and is reflective of what we’re seeing in the bigger picture. Large, reputable companies such as Amazon, Capital One, Twitter, Facebook, Google, Microsoft and many others have elected to keep working from home – even after the pandemic. These decisions by large and influential organizations are setting a new precedent and opening the door to go back to the drawing board and re-envision the working life and the new ways of interacting with the outside world. Later in the interview, Jeff Nielsen underscores what we can (or can’t) currently forecast from the data alone,

“Everything we’re seeing says it’s going to be very, very slow. I don’t know when we’ll see the number of people unlocking doors with a physical credential like they were back in January or February. That could be a couple of years off.”

Where We Are Going

While certain industries have been more impacted than others, like gyms, retail and education, businesses are constantly adapting and innovating their operations and processes to remain successful. Gyms and healthcare facilities are implementing strict social distancing policies, limiting occupancy and increasing their frequency of thorough sanitizing. Students and school faculty are now primarily using tele-education tools like Zoom or Google Hangout. Now retail giants who primarily focus on in-person and face to face interactions are moving their operations online – resulting in a boom to the ecommerce industry as a whole.

In a recent report by JLL, pre-covid ecommerce leasing activity was just 35% whereas now, that number is up to 50% and will continue to climb as more retailers and shoppers go on the web to buy goods. JLL also predicts total online sales could reach $1.5 trillion by 2025 – a forecast sure to shake up our notions of returning to ‘normal.’ In the same report by JLL, they conclude by stating that the US may need another 1 billion square feet of warehouse space dedicated just to satisfy the growing demand from ecommerce – warehousing, to manufacturing, and delivery, are all challenges that will need to be overcome in order to fill the demand from this pandemic driven ecommerce boom.

As we continue forward, data will play a critical role in how we learn and adapt our businesses and industries to thrive in this new normal. Data collectors and gatherers, like the New York Times and Brivo, will continue to monitor the data closely and innovate the ways they visualize and distribute the information to give us insights into new opportunities and patterns. Collaborators will continue to contextualize the data to provide analysis and insights that will help governing bodies and organizations to make informed decisions that will better serve their communities.

Stay up to date on COVID-19 recovery with