Death and taxes. They are the only things that you can guarantee. Oh, and the demise of the commercial real estate market after COVID. Who can argue with the innumerable obituaries, reminiscences and eulogies we’ve seen regarding the office building? Soon every office worker who wants to will be working at home, commute-free, while corporate real estate is converted to other uses.

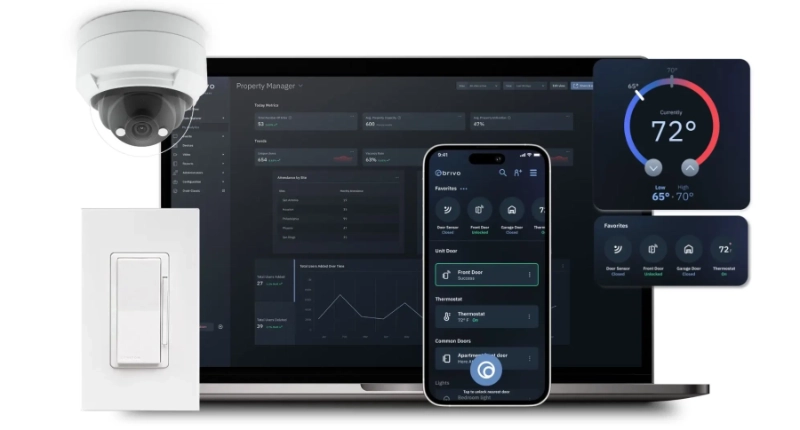

That was the thought, anyway. As it turns out, the pundits may be wrong. A recent survey by Brivo shows that while 18% plan to shrink their real estate footprint, another 10% harbor expansion plans. That leaves 72% unchanged. And the bullish 10% may offset the skittish 18% by acquiring the latter’s share of the market.

Plus, according to property management firm CBRE, office leasing in the United States in 2021 actually increased 27% from the year before. Who is gobbling up the spare square footage? Tech companies, says CBRE. That may sound strange given that monoliths like Meta and Twitter pledged to go virtual.

Yet an analysis by CBRE shows that tech companies held 36 of the 100 largest office leases in 2021, doubling the number from the year before. That’s 11.4 million square feet of conference rooms, offices, server rooms, shared workspaces and kitchens. In fact, Meta, Google, Microsoft and many other tech firms have quietly expanded their physical footprint, sometimes significantly. Basecamp is the rare outlier that has relinquished all of its real property.

In Forbes magazine, the head of investments at Cadre, a real estate investment firm, says that “most signs are pointing to another strong year in commercial real estate,” propelled by real-estate fund managers seeking growth opportunities. The author projects growth across several sectors, “driving price appreciation past pre-pandemic levels.” Multifamily and industrial properties will pave the way. He predicts that while cities like New York may lag, the property market in Phoenix, Atlanta and Charlotte will be hot as jobs and populations migrate to these cities.

A boom in the market for industrial properties such as warehouses and final-mile distribution centers is also buoying the commercial real estate market, according to Dealpath, which creates software for real estate investment management. Taylor Johnson, a PR firm in the real estate space, says that healthcare facilities and life sciences firms are scooping up and building new property to address the redoubled focus on health and wellness.

In the meantime, while hybrid work has precluded a full-fledged return to the office, traditional office-based businesses such as law firms, accountants, trade associations, finance, government and media are not shedding space en masse. They are taking a measured approach to leasing. In fact, some have moved into so-called trophy properties to entice workers back to the office with premium amenities.

While these signs are positive, we face a continuing period of uncertainty about the return to the office and the health of the commercial real estate market. You can cross off the implosion of that market from the short list of life’s certainties. But don’t forget to file your tax returns.

To learn more about the latest trends in office occupancy and security, download the Brivo 2022 Top Security Trends report.