Brivo wins Best Dealer Protection Policies and Best Manufacturer Technical Support

BETHESDA, MD., DECEMBER 7, 2021

Brivo – the global leader in cloud-based access control and smart building technologies that recently entered into a definitive merger agreement with Crown PropTech Acquisitions (NYSE: CPTK), was recognized with two Security Sales & Integration (SSI) Supplier Stellar Service Awards including Gold Best Dealer Protection Policies and Bronze Best Technical Support in the manufacturer categories. Presented by SSI, the security industry’s premier technology and business source of trusted content, these awards recognize the security industry’s top performing products, manufacturers, wholesale distributors and third-party central station monitoring providers. Nominations for these awards are sourced directly from SSI’s dealer and integrator audience representing the views of actual dealers in the field and their experiences with various providers.

“The Supplier Stellar Service awards Brivo received demonstrate our decades-long commitment to delivering the highest caliber of service and support to our channel partner community of security system integrators and installers,” said Brivo Founder and CEO, Steve Van Till. “As we continue to grow and make strides in our journey as a global smart building company, this recognition is a testament to the fact that the quality of our partner program policies and technical support remain a priority.”

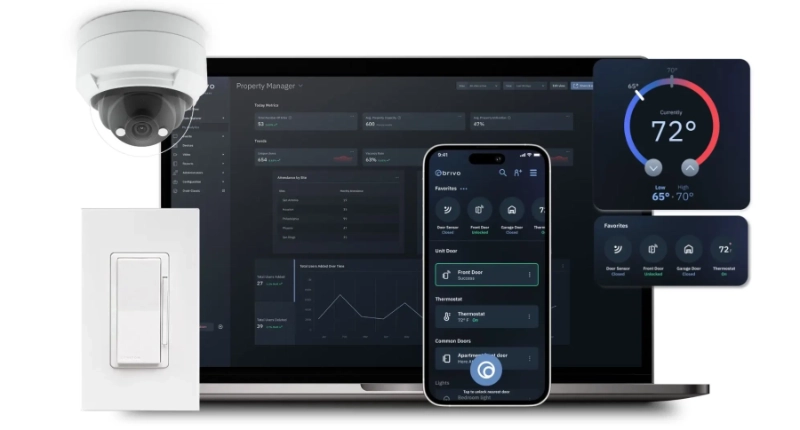

Brivo provides a business and economic model for channel partner growth that includes strong operational and technical support for its comprehensive product suite, which includes access control, smart readers, touchless mobile credentials, visitor management, occupancy monitoring, health and safety features, smart apartments and integrated video surveillance, smart locks, and intercoms. Valued for its simple installation, high-reliability backbone and rich API partner network, Brivo has the longest track record of cybersecurity audits and privacy protections in the industry.

SSI launched the Supplier Stellar Service Awards in 2021 to recognize suppliers that go above and beyond to deliver premium support and service. The purpose of the awards is also to create a valuable feedback loop for security dealers and integrators to communicate voice-of-the-customer opinions, according to the SSI website.

“We’re thrilled to kick off the Supplier Stellar Service Awards to honor outstanding customer support and service providers, like Brivo, that span a broad range of support and service areas,” said SSI Editor-in-Chief and Associate Publisher Scott Goldfine. “At Security Sales & Integration, we pride ourselves in being the security industry’s premier technology and business source of trusted content. The inauguration of these awards further solidifies our role as that voice.”

Click here to learn more about the suite of Brivo solutions.

Click here to learn how to become a Brivo security integrator and partner.

On November 10, 2021, Brivo entered into a definitive merger agreement with Crown PropTech Acquisitions (NYSE:CPTK) that will result in Brivo becoming a publicly listed company on the New York Stock Exchange under the new ticker symbol “BRVS.” Additional information about the transaction can be viewed here: brivo.com/about/investor-relations. Legal Disclaimer: https://brivo.com/about/investor-relations/legal-disclaimer/.

About Brivo

Brivo, Inc., created the cloud-based access control and smart spaces technology category over 20 years ago and remains the global leader serving commercial real estate, multifamily residential and large distributed enterprises. The company’s comprehensive product ecosystem and open API provide businesses with powerful digital tools to increase security automation, elevate employee and tenant experience, and improve the safety of all people and assets in the built environment. Brivo’s building access platform is now the digital foundation for the largest collection of customer facilities in the world, occupying over 300 million square feet across 42 countries. On November 10, 2021, Brivo entered into a definitive merger agreement with Crown PropTech Acquisitions (NYSE: CPTK) that will result in Brivo becoming a publicly listed company on the New York Stock Exchange under the new ticker symbol “BRVS.” Learn more at www.Brivo.com.

This press release is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination (the “proposed business combination”) between Brivo, Inc. (“Brivo”) and Crown PropTech Acquisition Corp. (“Crown”) and related transactions and for no other purpose.

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, expectations related to the terms and timing of the proposed business combination. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of Brivo’s and Crown’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Brivo and Crown. These forward-looking statements are subject to a number of risks and uncertainties, including the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination or that the approval of the shareholders of Crown or Brivo is not obtained; the risk that the conditions to the financing for the proposed business combination may not be satisfied or waived; the risk that the combined company’s securities will not be approved for listed on the New York Stock Exchange or if approved, maintain the listing; and those factors discussed in Crown’s final prospectus dated February 8, 2021 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, dated August 16, 2021, and, when available, the preliminary proxy statement/prospectus of Crown related to the proposed business combination, in each case, under the heading “Risk Factors,” and other documents of Crown filed, or to be filed, with the Securities and Exchange Commission (“SEC”). If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Crown nor Brivo presently know or that Crown and Brivo currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Crown’s and Brivo’s expectations, plans or forecasts of future events and views as of the date of this presentation. Crown and Brivo anticipate that subsequent events and developments will cause Crown’s and Brivo’s assessments to change. However, while Crown and Brivo may elect to update these forward-looking statements at some point in the future, Crown and Brivo specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Crown’s and Brivo’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information About the Proposed Business Combination and Where To Find It

The proposed business combination will be submitted to shareholders of Crown for their consideration. Crown intends to file a registration statement on Form S-4 (the “Registration Statement”) with the SEC which will include preliminary and definitive proxy statements to be distributed to Crown’s shareholders in connection with Crown’s solicitation for proxies for the vote by Crown’s shareholders in connection with the proposed business combination and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Brivo’s shareholders in connection with the completion of the proposed business combination. After the Registration Statement has been filed and declared effective, Crown will mail a definitive proxy statement and other relevant documents to its shareholders as of the record date established for voting on the proposed business combination. Crown’s shareholders and other interested persons are advised to read, once available, the preliminary proxy statement / prospectus and any amendments thereto and, once available, the definitive proxy statement / prospectus, in connection with Crown’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the proposed business combination, because these documents will contain important information about Crown, Brivo and the proposed business combination. Shareholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the proposed business combination and other documents filed with the SEC by Crown, without charge, at the SEC’s website located at www.sec.gov or by directing a request to 667 Madison Avenue, 12th Floor, New York, NY 10065, attention: Nikki Sacks.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

Crown, Brivo and certain of their respective directors, executive officers and other members of management, employees and consultants may, under SEC rules, be deemed to be participants in the solicitations of proxies from Crown’s shareholders in connection with the proposed business combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Crown’s shareholders in connection with the proposed business combination will be set forth in Crown’s proxy statement / prospectus when it is filed with the SEC. You can find more information about Crown’s directors and executive officers in Crown’s final prospectus dated February 8, 2021 and filed with the SEC on February 10, 2021. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the proxy statement / prospectus when it becomes available. Shareholders, potential investors and other interested persons should read the proxy statement / prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

.